Eurasian Development Bank Streamlines Safe Remittance Process

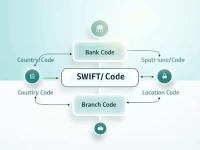

The SWIFT code for the Eurasian Development Bank is EABRKZKAXXX. Using this code accurately for remittances ensures that funds reach their destination securely and efficiently. This article discusses how to avoid transfer errors using SWIFT codes and provides information on related exchange rates and fees to enhance transfer efficiency and security.